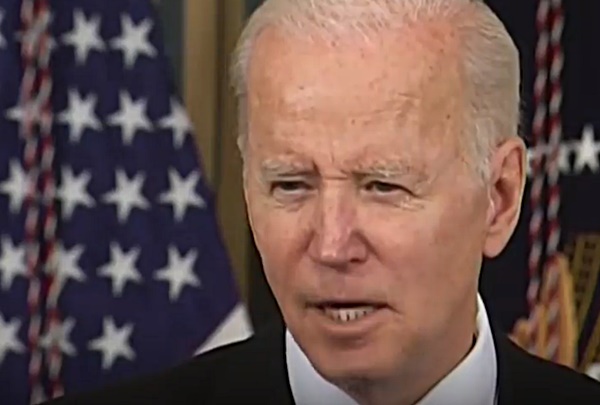

Biden to Propose Billionaire Tax Not Liked By The Wealthy!

President Biden is wanting to make the extreme wealthy play their part in helping the US get out of debt and help the less fortunate. Is it fair? Yes, but some think otherwise. Many rich people are quick to help other countries, but when it comes to helping the less fortunate or shall we say people living off the government, they would rather turn a blind eye to the growing epidemic. President Biden has a solution, but how will it actually breakdown for anyone who earns over $100 million per year?

View this post on Instagram

CelebnPolitics247.com reports that liquidity issues would make President Joe Biden’s proposed “billionaire tax” difficult to execute, Tyler Goodspeed, former acting chairman and vice chairman of the Council of Economic Advisers, told Yahoo Finance Live in a recent interview.

He said:

I think my main reaction is, it strikes me as a little bit gimmicky in an election year. Look, if you think that billionaires should be paying more in taxes, then I think you should be seriously considering an elimination of the step up in basis at the time that the estate tax is levied.

Biden’s 2023 proposed budget would impose a mandatory minimum tax rate of 20 percent of cumulative income, including unrealized investment income that currently is untaxed, for people worth more than $100 million.

The White House said in a press release:

For too long, our tax code has rewarded wealth, not work, and contributed to growing income and wealth inequality in America. Under current law, when an American worker earns a dollar of wages, that dollar is taxed as they earn it. But when a billionaire earns income because their investments increase in value, that gain is too often never taxed at all.

He adds:

There are lots of issues when you start taxing unrealized capital gains. How do you value some of those assets? A lot of those assets are not perfectly liquid. And how do you handle cash flow issues that some of these folks may have to liquidate some of those assets, some of those illiquid assets, in order to pay that tax liability even if it’s stretched out over several years.

Why The Wealthy Stay Wealthy and The Poor Get poorer!

Under current federal tax code, most assets are only subject to taxes after they are sold and the gains are fully appreciated. Certain exemptions apply for the sale of a house which has been occupied by the owner for two or more years and other illiquid assets.

However, a large percentage of billionaires’ wealth is held in unrealized stocks and securities, which are generally not subject to federal income taxes. Back in 2019, for example, about 99% of billionaire Warren Buffett’s $85 billion net worth is tied to his conglomerate holding company, Berkshire Hathaway (BRK-A, BRK-B).

If dividends from capital gains are taxed, they are generally taxed at a preferred, lower rate than other income. This is part of the way that wealthy individuals can amass fortunes in the twelve-figure range while paying a comparatively small tax rate, according to Yahoo Finance.